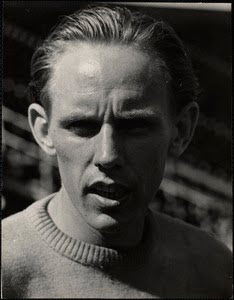

I received word a few weeks ago that former University of Oklahoma teammate and US Olympian (Rome 1960) Anthony "Tony" Watson had passed away last March 9, 2021.

In May of 1960, Anthony was on a partial scholarship at Oklahoma and washing dishes to pay for his tuition in the jock dining hall. By July he was on the US Olympic team having placed second behind Ralph Boston at the Olympic trials in Palo Alto, CA with a jump of 25' 9 1/4" That was a quick rise from being an awkward high school basketball player at Douglas HS in Oklahoma City. One of my Peace Corps colleagues, Steve Fisher, remembers playing against Anthony and seeing him bang his head on the bankboard that night.

In 1960 college freshman were not eligible to compete in varsity sports, so Tony may have participated in one indoor and one outdoor state AAU meet by the end of school, but he must have shown a lot of promise, because Oklahoma had two outstanding potential Olympians, Dee Givens and J.D. Martin that year who were chosen to continue competing when school was out, and Tony was taken along for the ride as well. I believe he jumped at the Houston Meet of Champions, did well and then watched the NCAA meet, before going to the trials. Subsequently he was the only one of the three who made the Olympic team. On the way there his freshman duties included carrying everyone's bags into the hotel. On the way home they carried their own bags, according to Tony. In 1962 he again made the US team that toured Europe and competed in dual meets against the Soviet Union, Poland, and Germany. He won three events at the Big 8 meet and anchored the 4x110 relay team to victory.

Mark Sullivan handing off to Tony Watson4x 220 Texas Relays 1962 photo by George Brose

Though Tony did not burn it up in the classroom in those days, he had charisma. On trips where we met other teams, people gathered around him and Jim Dupree. He told stories as well as anyone. Our coach in those days was Bill Carroll. Bill would get us all fired up before meets with comments like, "this ain't no county meet." and they put their pants on one leg at a time just like we do." Tony added, "They put their pants on one leg at a time,......vastly superior legs." He was referring to Texas Southern University who dominated the big relay meets in the sprints that year.

When he left Oklahoma University, he left the state behind as well. I had heard that he went to New York City having seen it on the Russian trip. He was working for the Public Health Department going door to door administering V.D. tests. Then years later I saw in another article that he was president of the Public Health Workers Union, and he owned a farm north of the city. There was some controversy that the company cars, Jaguars, that he used were very luxurious, but his argument was it was the only one he could get his 6' 4" frame into comfortably. He certainly did have long legs, and it was incredible to see him run the 100 and 220 getting those legs going and then just eat up the cinders while everyone else looked like middle distance runners.

Below is a clipping of a low key dual meet with Texas Tech in 1964. Event times were definitely low key except for that 100 in 9.3, hand timed, and 21.5 also hand timed on a not very swift cinder track.

Tony Watson, Frank Deramus, Preston Bagley, and Bill Griffin Drake Relays 4x110 champions

"Great stuff on Tony Watson (except for the part that was obscured by other print). Your first hand relationship as a teammate really added to it. The photo of Tony as an older guy makes me think he wasn't a regular at the health club. So often great athletes have experienced the glory of their youth and that is enough - please pass that chocolate cake. That said, for those, like myself, who were considerably less talented, often that lack of recognition is enough incentive to keep going. " Roy Mason

The following article about Anthony Watson is from the April 11, 1993 New York Times.

Profile/Anthony L. Watson; Fighting an Image of Cattle-Car Health Care

By Peter Kerr

POUND for pound in polished metal and marble, the new Fifth Avenue headquarters of the Health Insurance Plan of Greater New York can match those of most Wall Street firms for pre-crash, post-modern stylishness. Wood paneling is everywhere. Suits and ties are now mandatory; anything that suggests public-sector dreariness is anathema.

Anthony L. Watson, chief executive of the organization that is New York's largest health maintenance organization and is commonly known as HIP, insists on such appearances. "These offices were designed to project the image of a first-class organization," said Mr. Watson, whose towering frame stands out more than his elegantly tailored suits at HIP's offices. "That's what we are now."

Those are brave words for the leader of an organization long reputed to be about as service-oriented as the Department of Motor Vehicles.

HIP, a nonprofit company with more than $1 billion a year in revenues and almost a million members at 74 HIP medical centers in New York and New Jersey, has suffered from an image of being the least desirable health care option for city workers and others who cannot afford anything more.

ADVERTISEMENT

Partly because of that poor reputation, tens of thousands of city workers fled the organization in the 1970's and 1980's. Even Mr. Watson himself left HIP in disgust 22 years ago when he was a New York City employee.

But the 52-year-old Mr. Watson says he is leading a renaissance at HIP -- spiffing up the main offices, yes, but more important, building better-equipped medical centers and closing older ones that evoke the feel of public health care. He is also retraining staff to deal better with customers. As a result, he says, HIP is now positioned to flourish under widely anticipated Federal proposals that would steer Americans to good low-cost health plans.

Such proposals, under a system known as managed competition, would force insurers like HIP to compete on the basis of price and quality for the business of insurance-purchasing cooperatives.

"If managed competition comes, New York is mine," Mr. Watson said. "I'm going to be the lowest-cost plan. I will offer the best plan. I can do it without lowering quality and without rationing."

Perhaps New York could be his. But will it be healthy and happy? Among Mr. Watson's challenges is to deal with a reputation for second-class service and to convince New Yorkers that he is giving HIP something more than a new facade.

By Peter Kerr

POUND for pound in polished metal and marble, the new Fifth Avenue headquarters of the Health Insurance Plan of Greater New York can match those of most Wall Street firms for pre-crash, post-modern stylishness. Wood paneling is everywhere. Suits and ties are now mandatory; anything that suggests public-sector dreariness is anathema.

Anthony L. Watson, chief executive of the organization that is New York's largest health maintenance organization and is commonly known as HIP, insists on such appearances. "These offices were designed to project the image of a first-class organization," said Mr. Watson, whose towering frame stands out more than his elegantly tailored suits at HIP's offices. "That's what we are now."

Those are brave words for the leader of an organization long reputed to be about as service-oriented as the Department of Motor Vehicles.

HIP, a nonprofit company with more than $1 billion a year in revenues and almost a million members at 74 HIP medical centers in New York and New Jersey, has suffered from an image of being the least desirable health care option for city workers and others who cannot afford anything more.

ADVERTISEMENT

Partly because of that poor reputation, tens of thousands of city workers fled the organization in the 1970's and 1980's. Even Mr. Watson himself left HIP in disgust 22 years ago when he was a New York City employee.

But the 52-year-old Mr. Watson says he is leading a renaissance at HIP -- spiffing up the main offices, yes, but more important, building better-equipped medical centers and closing older ones that evoke the feel of public health care. He is also retraining staff to deal better with customers. As a result, he says, HIP is now positioned to flourish under widely anticipated Federal proposals that would steer Americans to good low-cost health plans.

Such proposals, under a system known as managed competition, would force insurers like HIP to compete on the basis of price and quality for the business of insurance-purchasing cooperatives.

"If managed competition comes, New York is mine," Mr. Watson said. "I'm going to be the lowest-cost plan. I will offer the best plan. I can do it without lowering quality and without rationing."

Perhaps New York could be his. But will it be healthy and happy? Among Mr. Watson's challenges is to deal with a reputation for second-class service and to convince New Yorkers that he is giving HIP something more than a new facade.

Health maintenance organizations -- which charge a fixed price per member no matter how much care is provided, as opposed to a separate fee for each service -- have historically offered the least expensive coverage. Of the H.M.O.'s in the New York area, HIP is the least expensive.

Among the reasons: It employs its own doctors (986 of them) in its own centers, which allows management to closely supervise their activities; it runs its own laboratories and it orders its drugs in bulk. The standard charge for individuals in group plans is $137.66 per month and for families $337.26 -- with no copayments or deductibles.

"Their prospects are probably good under any health-care-reform scenario," said Douglas B. Sherlock, president of the Sherlock Company, which gives financial advice to H.M.O.'s. "They have unique advantages in controlling costs."

A reference to the luxury car(s) is at the end of the following article published in The New York Sun on April 24, 2008 by Jacob Gershman.

Health maintenance organizations -- which charge a fixed price per member no matter how much care is provided, as opposed to a separate fee for each service -- have historically offered the least expensive coverage. Of the H.M.O.'s in the New York area, HIP is the least expensive.

Among the reasons: It employs its own doctors (986 of them) in its own centers, which allows management to closely supervise their activities; it runs its own laboratories and it orders its drugs in bulk. The standard charge for individuals in group plans is $137.66 per month and for families $337.26 -- with no copayments or deductibles.

"Their prospects are probably good under any health-care-reform scenario," said Douglas B. Sherlock, president of the Sherlock Company, which gives financial advice to H.M.O.'s. "They have unique advantages in controlling costs."

A reference to the luxury car(s) is at the end of the following article published in The New York Sun on April 24, 2008 by Jacob Gershman.

$20 Million Could Flow To HIP CEO

Big Option Could result From Planned MergerThe top executive of the city's largest health maintenance organization, whose salary more than doubled last year to $4.79 million, is poised to reap an even bigger payday if state regulators approve the nonprofit insurer's conversion to a for-profit public company.

The chief executive officer of the Health Insurance Plan of New York, Anthony Watson, would be awarded a stock option package that sources say could be worth as much as $20 million.

According to a provision in his most recent employment agreement, Mr. Watson would be given an option to purchase 1.2% of the shares that are issued on the six-month anniversary of the conversion. The options are expected to be priced at market value on that date.

While the option would be time-vested over four years, Mr. Watson would be permitted to exercise the option to purchase the stock immediately if another insurance company acquires EmblemHealth, which was recently formed by the union of HIP and another major nonprofit insurer, Group Health Inc. EmblemHealth is seeking approval to change its status to for-profit from the state insurance department.

The compensation agreement for Mr. Watson was approved by the board of directors of EmblemHealth, which includes James Gill, a partner at the law firm, Bryan Cave who is also the chairman of the Battery Park City Authority, and Carl Haynes, the former president of Teamsters Local 237.

A spokesman for EmblemHealth declined to discuss details of the potential pay package, which was submitted to the state insurance department as a proprietary document.

"It is premature to speculate on what might happen if and when a plan of conversion is approved," a spokesman for HIP, Pat Smith of Rubenstein Associates, said.

The stock package plan threatens to complicate the insurer's efforts to secure for-profit status.

Labors unions, the largest customer of HIP, have already expressed fears that EmblemHealth's conversion — and a subsequent sale of the company — could lead to higher premiums for their members, while state regulators have chastised the financially struggling company for excessive spending. The compensation is also raising the eyebrows of state lawmakers.

"When they are considering whether the package is in the public interest, they should be weighing the amount of wealth that will be going into a few private hands as opposed to benefiting the public or the patients," a Democratic assemblyman of Manhattan, Richard Gottfried, said. Mr. Gottfried is chairman of the Assembly's health committee.

The disclosure of the pay package also comes at a time when the issue of executive compensation has been in the spotlight of the presidential race, as both Senators Clinton and Obama have offered dueling proposals for tightening restrictions on executive pay.

Compensation of non-profit executives has been a hot political issue in New York as well, with Attorney General Eliot Spitzer in 2004 launching a high-profile lawsuit against Richard Grasso after it was disclosed that Mr. Grasso, head of the then-non-profit New York Stock Exchange, was to be paid $200 million in compensation and retirement benefits.

The state insurance department has raised questions about Mr. Watson's compensation, which increased last year to $4.79 million, including salary and bonuses, from $2.14 million in 2006, as reported last week by The New York Sun.

Mr. Watson's gross salary last year was more than three times the size of that of the CEO of GHI, Frank Branchini, whose company is about half the size of HIP.

HIP directors also increased the pay of HIP's chief financial officer and counsel, Michael Fullwood, to $1.99 million in 2007, up from $896,000 in 2006. The company's executive vice president for operations, John Steber, also saw his pay rise to $1.5 million from $763,000.

Mr. Watson's salary and future earnings are also becoming a point of contention with public employees unions, which make up the bulk of HIP's membership and have demanded a portion of the $1 billion to $3 billion that the state is expected to collect from the stock sale of EmblemHealth.

"The whole point of the merger and potential conversion to for-profit status is about continuing that commitment — not about the enrichment of a particular individual," the president of the United Federation of Teachers and chairman of the Municipal Labor Committee, Randi Weingarten, told the Sun in a statement. "If that becomes the driving force, then the legislative predicate for allowing the conversion must be re-considered," she said.

Ms. Weingarten, in a February letter to the superintendent of insurance, Eric Dinallo, on behalf of the Municipal Labor Committee, said union officials are also demanding that the insurance department impose a multi-year "freeze" of any sale of EmblemHealth if it converts to for-profit.

The criticism facing Mr. Watson's employment agreement is not the first time that his compensation has come under scrutiny.

In 2000, the state insurance department, in a scathing report, criticized the non-profit corporation for lavishing corporate-style perks on Mr. Watson and other executives while the company was in financial trouble.

The report found that HIP, which Mayor Fiorello La Guardia and labor unions founded in 1947 so that city employees would have access to inexpensive health care, spent hundreds of thousands of dollars leasing Mr. Watson two new Jaguars and renting him a luxury resort apartment near Miami where he often took his wife and children.

At the time, a spokesman for HIP said Mr. Watson, a former Olympic long jumper who took over the company in 1990, said the CEO needed the Jaguars because the luxury sedan accommodated his long legs, the Daily News reported.

"He has a real problem fitting into other cars," the spokesman reportedly said.

George,

Bill Carroll invited me to the OU versus Kansas Dual at Norman in 1962. I had just won the Oklahoma State Championship 440. I had no idea what Collegiate athletes could do but I found out! They were way above my “league”!

Anthony Watson was the most impressive sprinter that I had ever seen. Very tall and so fast that it looked unfair! Bill Dotson was also running in that meet. Dotson was super smooth and just dominated in the mile. I still remember their performances almost 60 years later!

Now they are both gone! However, the memory of that day and their performances will linger in my memory forever!

This is what is so unique to track whether you are running or watching! You always remember a big race forever! I saw Ryun’s 880 (1966) and Mile (1967) World Records and can describe them in detail with splits. I can also give you splits and results of every important race in which I competed including my two Big 8 Championship races that I won by inches or less! I also can describe in detail our Two Mile Relay World Record in 1965 as well as every other two mile relay race in 1965 and 1966! Don’t know if it’s adrenalin or endorphins but watching or competing in a big event is definitely a memory enhancer.

I guess we need more “big events”!

John Perry

The top executive of the city's largest health maintenance organization, whose salary more than doubled last year to $4.79 million, is poised to reap an even bigger payday if state regulators approve the nonprofit insurer's conversion to a for-profit public company.

The chief executive officer of the Health Insurance Plan of New York, Anthony Watson, would be awarded a stock option package that sources say could be worth as much as $20 million.

According to a provision in his most recent employment agreement, Mr. Watson would be given an option to purchase 1.2% of the shares that are issued on the six-month anniversary of the conversion. The options are expected to be priced at market value on that date.

While the option would be time-vested over four years, Mr. Watson would be permitted to exercise the option to purchase the stock immediately if another insurance company acquires EmblemHealth, which was recently formed by the union of HIP and another major nonprofit insurer, Group Health Inc. EmblemHealth is seeking approval to change its status to for-profit from the state insurance department.

The compensation agreement for Mr. Watson was approved by the board of directors of EmblemHealth, which includes James Gill, a partner at the law firm, Bryan Cave who is also the chairman of the Battery Park City Authority, and Carl Haynes, the former president of Teamsters Local 237.

A spokesman for EmblemHealth declined to discuss details of the potential pay package, which was submitted to the state insurance department as a proprietary document.

"It is premature to speculate on what might happen if and when a plan of conversion is approved," a spokesman for HIP, Pat Smith of Rubenstein Associates, said.

The stock package plan threatens to complicate the insurer's efforts to secure for-profit status.

Labors unions, the largest customer of HIP, have already expressed fears that EmblemHealth's conversion — and a subsequent sale of the company — could lead to higher premiums for their members, while state regulators have chastised the financially struggling company for excessive spending. The compensation is also raising the eyebrows of state lawmakers.

"When they are considering whether the package is in the public interest, they should be weighing the amount of wealth that will be going into a few private hands as opposed to benefiting the public or the patients," a Democratic assemblyman of Manhattan, Richard Gottfried, said. Mr. Gottfried is chairman of the Assembly's health committee.

The disclosure of the pay package also comes at a time when the issue of executive compensation has been in the spotlight of the presidential race, as both Senators Clinton and Obama have offered dueling proposals for tightening restrictions on executive pay.

Compensation of non-profit executives has been a hot political issue in New York as well, with Attorney General Eliot Spitzer in 2004 launching a high-profile lawsuit against Richard Grasso after it was disclosed that Mr. Grasso, head of the then-non-profit New York Stock Exchange, was to be paid $200 million in compensation and retirement benefits.

The state insurance department has raised questions about Mr. Watson's compensation, which increased last year to $4.79 million, including salary and bonuses, from $2.14 million in 2006, as reported last week by The New York Sun.

Mr. Watson's gross salary last year was more than three times the size of that of the CEO of GHI, Frank Branchini, whose company is about half the size of HIP.

HIP directors also increased the pay of HIP's chief financial officer and counsel, Michael Fullwood, to $1.99 million in 2007, up from $896,000 in 2006. The company's executive vice president for operations, John Steber, also saw his pay rise to $1.5 million from $763,000.

Mr. Watson's salary and future earnings are also becoming a point of contention with public employees unions, which make up the bulk of HIP's membership and have demanded a portion of the $1 billion to $3 billion that the state is expected to collect from the stock sale of EmblemHealth.

"The whole point of the merger and potential conversion to for-profit status is about continuing that commitment — not about the enrichment of a particular individual," the president of the United Federation of Teachers and chairman of the Municipal Labor Committee, Randi Weingarten, told the Sun in a statement. "If that becomes the driving force, then the legislative predicate for allowing the conversion must be re-considered," she said.

Ms. Weingarten, in a February letter to the superintendent of insurance, Eric Dinallo, on behalf of the Municipal Labor Committee, said union officials are also demanding that the insurance department impose a multi-year "freeze" of any sale of EmblemHealth if it converts to for-profit.

The criticism facing Mr. Watson's employment agreement is not the first time that his compensation has come under scrutiny.

In 2000, the state insurance department, in a scathing report, criticized the non-profit corporation for lavishing corporate-style perks on Mr. Watson and other executives while the company was in financial trouble.

The report found that HIP, which Mayor Fiorello La Guardia and labor unions founded in 1947 so that city employees would have access to inexpensive health care, spent hundreds of thousands of dollars leasing Mr. Watson two new Jaguars and renting him a luxury resort apartment near Miami where he often took his wife and children.

At the time, a spokesman for HIP said Mr. Watson, a former Olympic long jumper who took over the company in 1990, said the CEO needed the Jaguars because the luxury sedan accommodated his long legs, the Daily News reported.

"He has a real problem fitting into other cars," the spokesman reportedly said.

George,

No comments:

Post a Comment